Observers to a negotiation must sometimes think the parties go back-and-forth like hamsters in a Ferris wheel–running without moving; going round-and-round; ink never stopping. Thus it is with the Arbutus Corridor railway line property fight. But there are good business reasons for the Railway to get good return.

Observers to a negotiation must sometimes think the parties go back-and-forth like hamsters in a Ferris wheel–running without moving; going round-and-round; ink never stopping. Thus it is with the Arbutus Corridor railway line property fight. But there are good business reasons for the Railway to get good return.

The property covers approximately 20 hectares.

Canadian Pacific Railway (CPR) wants $100M for it. The City of Vancouver (COV) has offered $20M. CPR has reactivated the line so it can earn its keep. And the City has conceded it may want to profit from future sales.

$80M is a hard gap to bridge.

But there may be a neat twist; a relatively simple way to resolve the impasse, so both parties win.

But there may be a neat twist; a relatively simple way to resolve the impasse, so both parties win.

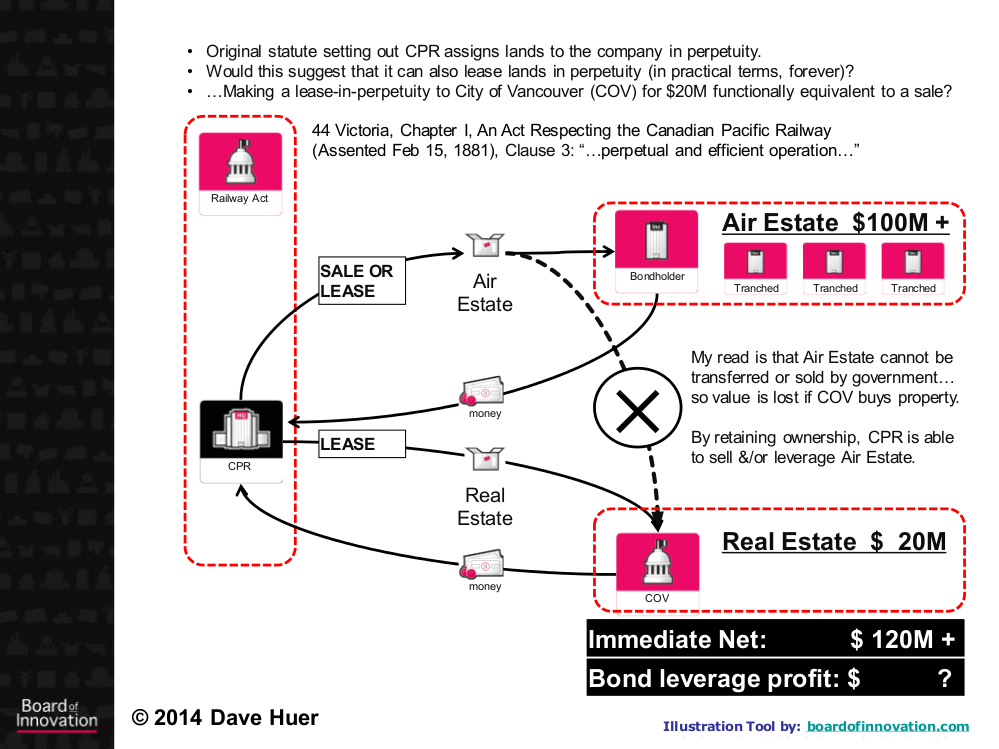

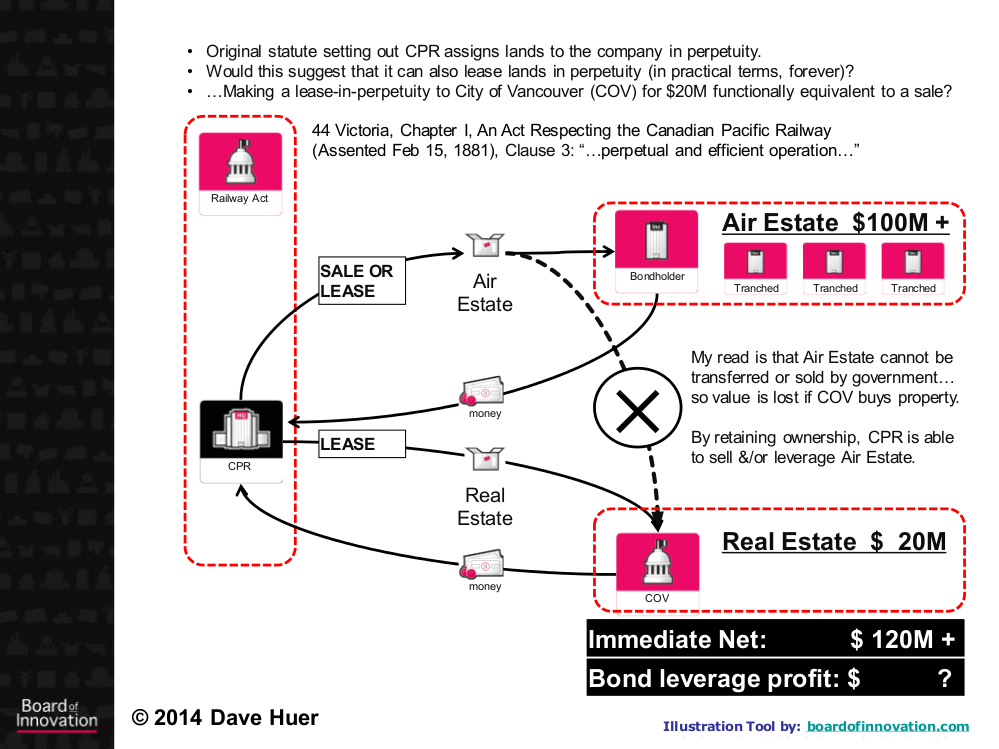

The original statute setting out the CPR assigns lands to carry out the “…perpetual and efficient operation…” of the railway: Clause 3: 44 Victoria, Chapter I, An Act Respecting the Canadian Pacific Railway� (Assented Feb 15, 1881).

1st) Would this suggest that CPR can also lease lands in perpetuity (in practical terms, forever)? Making a lease-in-perpetuity to COV for $20M functionally equivalent to a sale?

2nd) It appears that Air Estate values cannot be transferred or sold by government. If this is correct, the AE value is lost if the COV buys the property. By retaining ownership, CPR is able to sell &/or leverage the Air Estate.

Could we combine these two ideas to create a mechanism that works? Could the parties split the air rights (20 hectares of Air Estate: AE) from the real property (20 hectares of Real Estate: RE)? Could this produce a reasonable solution to the impasse, or a spark to bring the parties to the table? Could this create a win-win for everyone?

- * CPR leases RE to COV in perpetuity for $20M

- * CPR obtains the right to recover unneeded parcels for future sale

- * CPR sells or leases AE for $100M to Bondholders (Ledcor, OMERS, CPPIB)

- * Bondholders tranche the AE Bond and everyone takes a % of Leveraged Net

- * Net Pre-Leveraged Sale: $120M

3rd) Could this mechanism be used across Canada, for every disused railway line with continuing property asset value but under-performing operations’ asset values? Could it be used globally, in every jurisdiction where property rights include air rights?

Will this spark a run on disused urban railway lines, I wonder?

Will this spark a run on disused urban railway lines, I wonder?

By Dave Huer

Images:

Backhoe: the Province here

Queen Victoria stamp here

Diagram – personal artwork, using Board of Innovation business model tool. [PDF version here]

Abandoned railway line here by Elliott Brown (CC BY 2.0)

![]() My most recent venture

My most recent venture

But there may be a neat twist; a relatively simple way to resolve the impasse, so both parties win.

But there may be a neat twist; a relatively simple way to resolve the impasse, so both parties win.

Will this spark a run on disused urban railway lines, I wonder?

Will this spark a run on disused urban railway lines, I wonder?